Login For Employees

Login For Employers

Login For Partners

Medcom Secure Email Center

On the Road to Compliance: 5 Pit-Stops to Fuel Broker-Client Connections & Accelerate Your Business

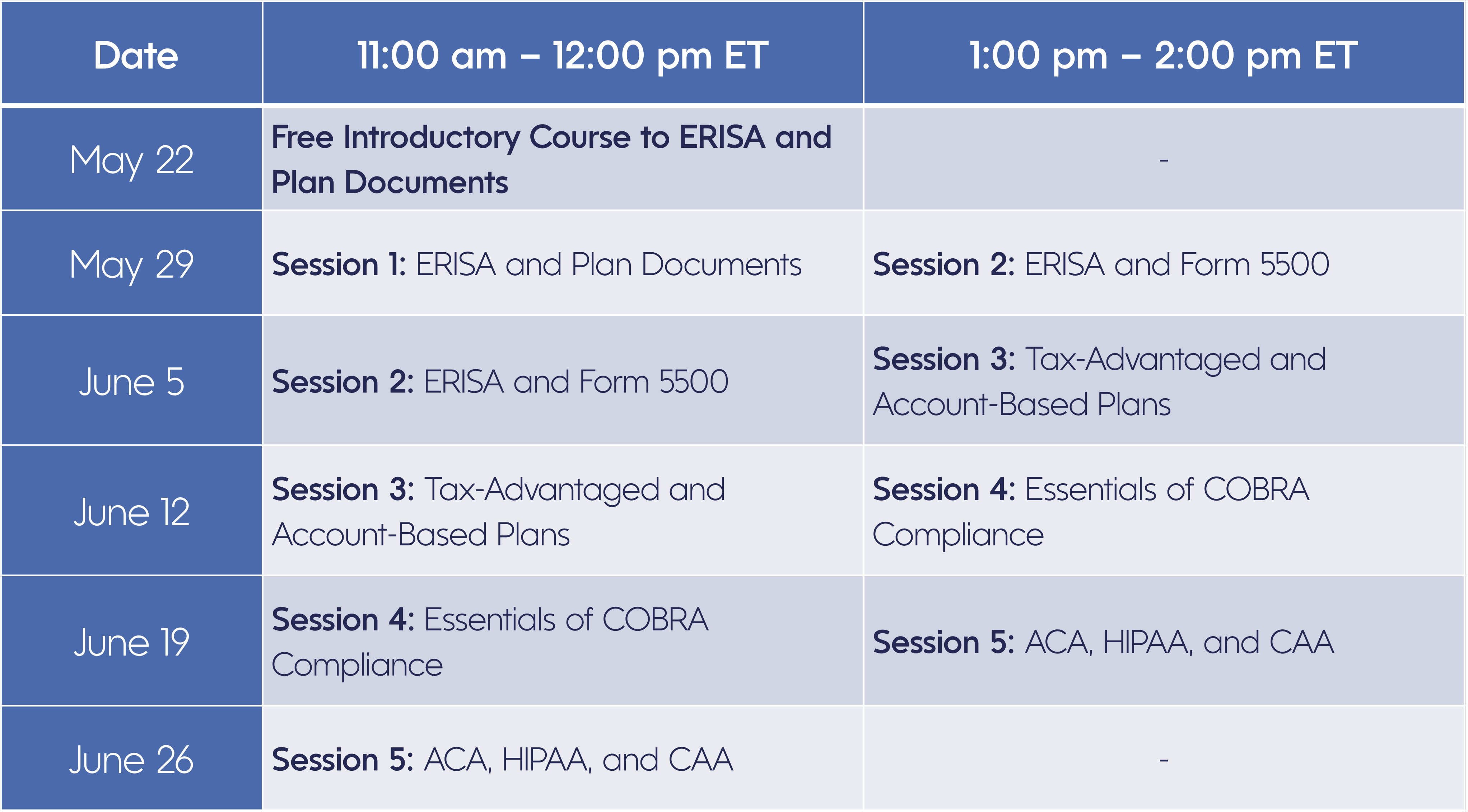

May 29, 2025 – June 26, 2025Embark on a journey to total benefits compliance with Medcom's exclusive brokers-only 5-part training program! This virtual series, led by Medcom's compliance experts, will run from May 29 to June 26. Over the course of five weeks, we will offer two concurrent series for ultimate flexibility.

Medcom prides itself on being a top service provider on Shortlister, BenefitPitch, and among national agencies for the quality and value of our services—including competitive, high-quality broker training. Don’t miss this opportunity to drive your business forward and strengthen your compliance knowledge!

Not sure if you're ready to commit? Join our ERISA Foundations session on May 22 free of charge!

Meet the Instructor

Derek Ashton, CEBS

Director of Training & Compliance Business Development

An in-demand speaker and host of the popular year-round “Compliance Recharge” series, Derek informs and entertains while delivering practical insights tailored to the interests of insurance producers, benefits consultants, and brokerage client service professionals. After earning a B.A. in Divinity, Derek attained the Group Benefits Associate (GBA), Compensation Management Specialist (CMS), and Certified Employee Benefit Specialist (CEBS) designations through the International Foundation of Employee Benefit Plans and the Wharton School of the University of Pennsylvania. After joining Medcom in 2012, he directed the company’s Compliance & Actuarial Division for over seven years and now serves in a compliance consulting, training, and business development leadership role.

Mary Catherine Waldron, J.D.

Senior Compliance Advisor

Mary Catherine Waldron, J.D., has been with Medcom Benefits Solutions for seven years. Mary Catherine graduated from the University of Central Florida, earning a Bachelor of Arts in English Literature, a Bachelor of Arts in History, and completed a Graduate program in Teaching English as a Foreign Language. Mary Catherine then earned her Juris Doctor in only two years, graduating with Honors recognition in Pro Bono legal services. While in law school, she was an active member of the nationally ranked Moot Court Honor Board and was a certified legal intern with the State Attorney’s Office for the 4th Judicial Circuit Special Prosecution Division and the 7th Judicial Circuit Court for the State of Florida. Mary Catherine enjoys working closely with her team as well as the Medcom partners and clients to provide guidance and assistance on the various facets of Health and Welfare Compliance. Mary Catherine’s main areas of focus are ERISA and Nondiscrimination Testing.

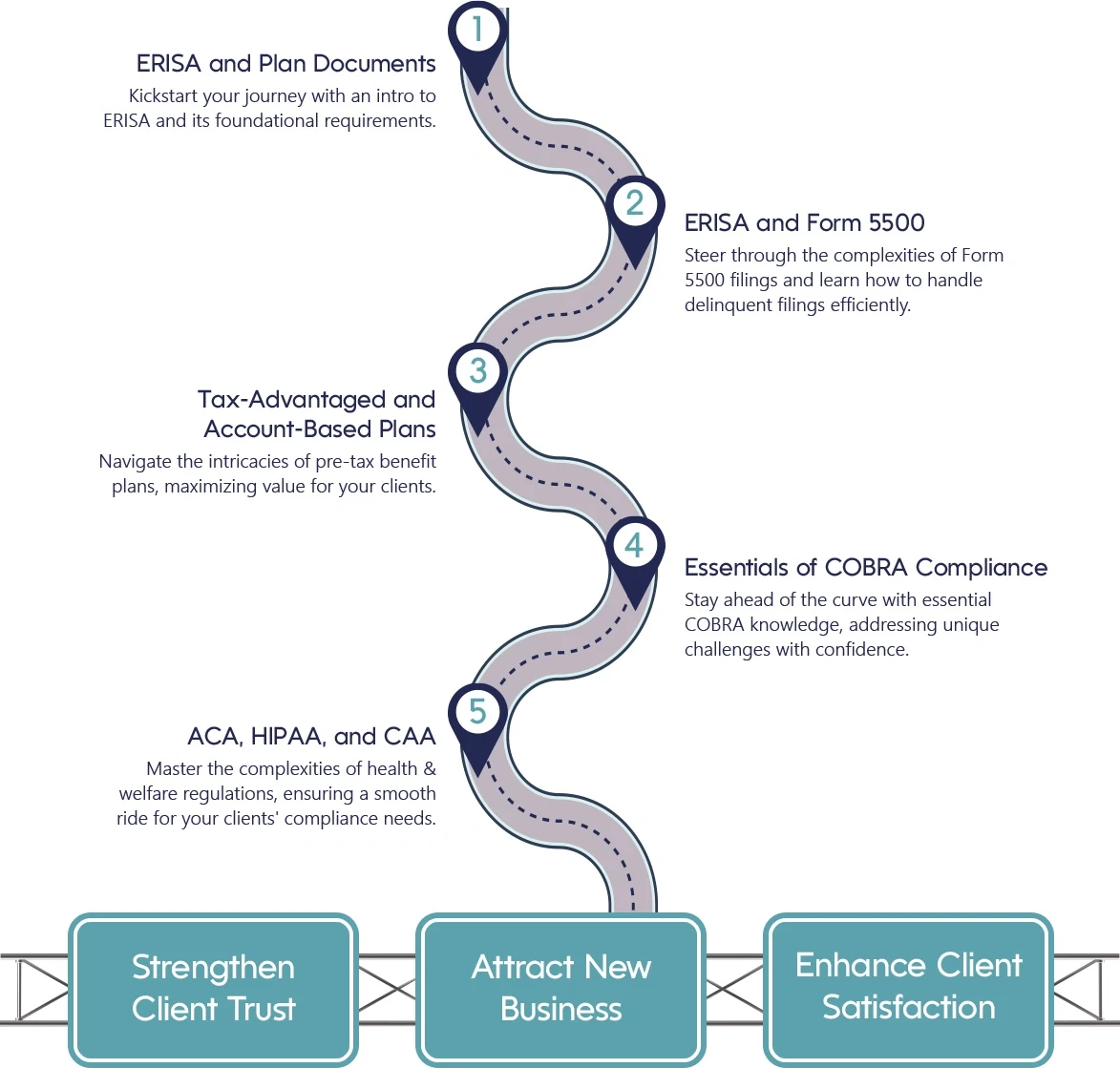

Training Agenda

Session 1: ERISA and Plan Documents

- Why Compliance is Important

- Introduction to ERISA

- Fiduciary Requirements

- Plan Document and SPD Requirements

- Wrap Documents

Session 2: ERISA and Form 5500

- How to Distribute SPDs, Notices, and Related Documents

- Form 5500 Overview

- How Wrap Documents Impact Form 5500 Filings

- Form 5500 Due Dates and Extensions

- The Summary Annual Report

- How to Handle Delinquent Filings

Session 3: Tax-Advantaged and Account-Based Plans

- Tax Code Compliance Overview

- Cafeteria Plan Compliance

- Mid-Year Election Changes

- Nondiscrimination Testing Overview

- NDT for Cafeteria Plans

- NDT for Self-Funded Medical, Dental, and Vision Plans

- Overview of HSAs

- Overview of HRAs

Session 4: Essentials of COBRA Compliance

- Employers & Plans Subject to COBRA

- COBRA Qualifying Events

- Maximum Coverage Periods, Disability Extensions, and Second Qualifying Events

- How COBRA is Impacted by Leaves of Absence, Severance Agreements, Merger/Acquisition Activity, and Other Scenarios

Session 5: ACA, HIPAA, and CAA

- ACA Compliance Requirements

- HIPAA Privacy & Security for Self-Funded Plans

- Overview of Consolidated Appropriations Act Compliance

- Transparency Rules

- RxDC Reporting

- Mental Health Parity Rules

- Gag Clause Attestations

Testimonials

“Derek is extremely engaging!”

“Derek is very knowledgeable and nice, he knows the topic is complex but still makes it interesting for everyone”

“Derek consistently delivers engaging and clear-cut explanations to some of the most mind-numbingly boring/complex compliance topics that plague the Employee Benefits insurance industry. He makes these topics both accessible and digestible. Hard thing to do…10/10, highly recommend.”