Keeping up with compliance requirements is crucial for employers, especially when it comes to employee benefits. Recent updates to penalties under HIPAA, MSP, and SBC highlight the importance of staying informed and maintaining best practices. Here’s a quick overview of the new penalty amounts for 2025.

HIPAA Penalties

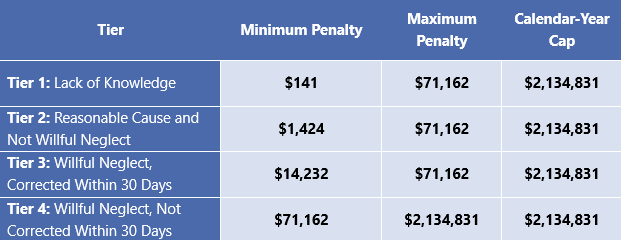

The Health Insurance Portability and Accountability Act (HIPAA) outlines penalties based on the level of violation:

MSP Penalties

The Medicare Secondary Payer (MSP) penalties also saw an increase:

SBC Penalties

Under the Summary of Benefits and Coverage (SBC) regulations, willful failure to provide an SBC increased to $1,406 from $1,362 for each failure

These increases are a reminder of the importance for employers and plan administrators to remain vigilant in employee benefit compliance. Ensuring compliance not only protects employers from hefty fines but also upholds the integrity of their employee benefits programs. Regularly review your processes, provide training, and seek expert guidance to stay ahead of these evolving requirements.