Worksite benefits are supplementary to major medical and ancillary benefits. They are often offered individually, and the employee works directly with the insurer. Most employers provide voluntary worksite benefits, so we want to share some things brokers can do to protect their groups regarding these plans.

Our goal is to support you in helping your clients make a clear decision about the ERISA status of voluntary benefits, which will enable them to manage significant compliance risks. Our line of business often sees significant compliance gaps that can lead to major problems. These risks typically show through DOL audits or lawsuits. And we don’t want it to get to that point.

What is an ERISA Welfare plan?

An ERISA welfare plan is a plan, fund, or program established OR maintained by an employer. It must provide medical care or other ERISA-listed benefits for employees and their beneficiaries.

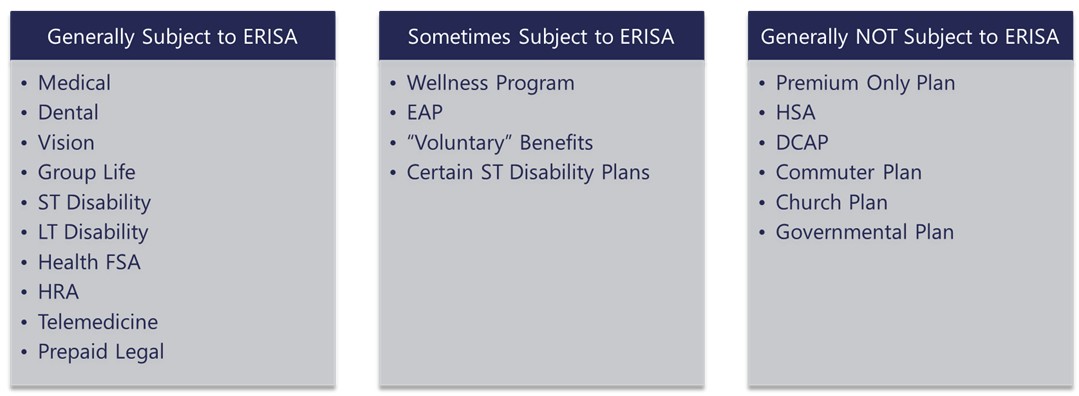

Which plans are subject to ERISA?

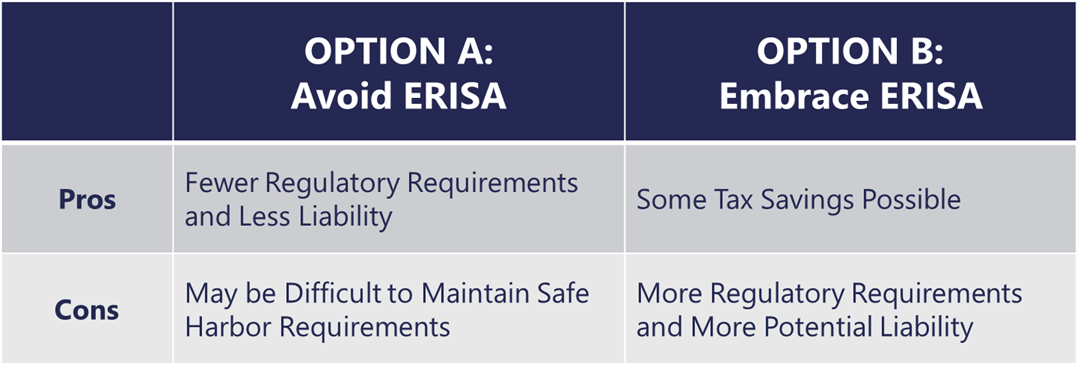

Brokers, you’ll have to decide to go ERISA or non-ERISA with your benefit plans, you cannot be in between. With voluntary benefits, employers have two options:

Voluntary Plan Safe Harbor lets you treat these types of plans as non-ERISA, but to meet the Safe Harbor, the employer must NOT:

- Contribute toward the cost of the plan

- Require participation (must be entirely voluntary)

- Receive any consideration (“cash or otherwise”)

- Endorse the program

Action Plan for Avoiding ERISA

- Check the handbook, benefit summaries, and other materials for endorsements.

- Remove employer endorsements and add disclaimers.

- Make sure the plan is not offered on a pre-tax basis.

- Follow the Safe Harbor rules and maintain distance.

Action Plan for Embracing ERISA

- Add voluntary plans to Wrap Document.

- Obtain and distribute plan descriptions.

- Consider offering voluntary plans on a pre-tax basis.

- Report plans on Form 5500, if applicable.

- Consider possible COBRA, HIPAA, ACA, and CAA implications.

So, some things to think about with voluntary worksite benefits are first if the plan is subject to ERISA in the first place. If it is, decide whether the employer would benefit more from avoiding or embracing it. Let Medcom Benefit Solutions help guide you and your clients to total compliance, so we can all breathe a little easier at the end of the day.

For any questions, please don’t hesitate to contact our compliance expert, Derek Ashton, CEBS.