Take Advantage of a 401(k) Now, Thank Yourself Later

Retiring ‘on time’ usually occurs between 62 and 70 years old. Are you on track to retire then? According to the U.S. Census Bureau, 79% of people work for a company that offers a 401(k) plan, but only 41% take advantage of it.

Everyone likes to talk about being able to retire early or before a certain age, but how do you make that happen? The pandemic brought many things to light for a lot of people that they wouldn’t have thought about had they not been forced to stay and work from home in their sweatpants. People are changing careers, making more time for family, prioritizing their hobbies, and planning their future. Along with that has come wide interest in retirement funds and saving for retirement.

Employers often offer 401(k) options to help you prepare. Do you know what your options are? Now is a good time to find out and ask some questions to make sure you’re getting the most out of it.

Employers will often match your contribution to your 401(k), which means you’re losing free money by not signing up! They’ll do this because they want to make it clear that they’re investing in you and your future. Even if your company doesn’t match, your contribution is fully tax-deductible, which could still be worth your while. Check out this article if your employer doesn’t match.

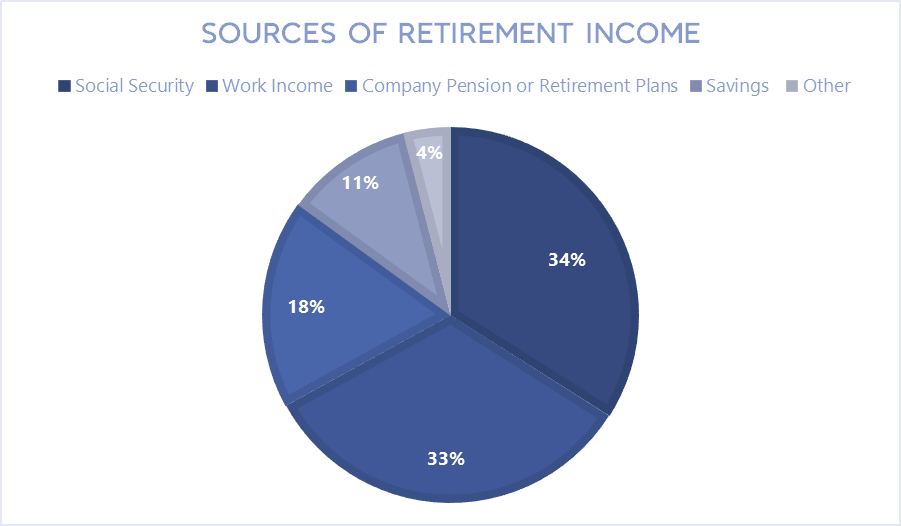

Make sure that you don’t retire and then wish you had saved more money. When you retire, will you really be retired? You want to make sure that you’ll be able to live comfortably off of what you saved. A few calculators are linked below to help you figure out how much you should contribute to a 401(k) if you want to retire at a certain age.

401(k) Calculators

Enrich is Medcom’s Financial Health platform and is a great way to plan your future and budget your present. They have articles, courses, and more to plan for whatever your financial goals are. To join or if you have questions, contact sales@medcombenefits.com.